The BCG matrix is a tool used in strategic management. It helps businesses analyze and categorize their different products, brands, or units. BCG stands for Boston Consulting Group. This matrix focuses on two key areas:

- The product’s market share compared to competitors.

- The growth potential of the product.

The growth-share matrix is based on the idea that being a market leader can lead to better and more sustainable profits. When a company is at the top, it often has lower costs that others find hard to match. Markets with high growth rates show where the most potential is.

BCG matrix encourages companies to think about two main things when deciding where to invest

- Their competitiveness and

- The market attraction.

These factors depend on how much market share a company has and how fast that market is growing.

The matrix is divided into four sections, each representing a different combination of market share and growth:

Image Source: professionalacademy.com

You can read more about the BCG matrix in detail here.

15 BCG Matrix Examples of Globally Renowned Companies

Here are 15 real-world BCG matrix examples.

1. BCG Matrix of Apple

In the BCG matrix, Stars are high-market-share products with strong growth potential, like Apple’s iPhones, which consistently top global sales.

Question Marks are products with low market share but high growth potential, such as Apple’s Smart TVs, which could become stars with effective marketing.

Cash Cows are well-established products like MacBooks and iTunes that generate steady profits in a stagnant market due to loyal customers.

Dogs are products like iPods that, despite their past success, struggle to generate revenue in a competitive landscape.

2. BCG Matrix of Microsoft

Microsoft’s well-known products, such as Windows and Office, are cash cows with high market share but low growth.

Emerging products like Surface hardware and Xbox are seen as question marks with growth potential. Meanwhile, stars like Microsoft Teams and Azure generate substantial revenue, while Windows phones are considered dogs due to discontinuation amid strong competition.

3. BCG Matrix of Adidas

Adidas AG, a German company recognized for its sportswear and footwear, became Europe’s top sportswear brand and the second largest globally after Nike.

The BCG matrix categorizes its products into four groups: Stars (top earners like Adidas and Reebok), Question Marks (high growth potential like Taylor Made and Rockport), Cash Cows (steady income items like clothing), and Dogs (low growth products like sunglasses and hats).

4. BCG Matrix of Amazon

Amazon.com and its AWS cloud services are classified as Stars due to significant market share and growth potential.

Question Marks include new offerings like Amazon Live and video on demand, which have uncertain futures.

Cash Cows, such as books and movies, generate steady income with minimal investment, while Dogs, like lesser-known physical stores and Alexa, have low revenue potential and may not get further investment.

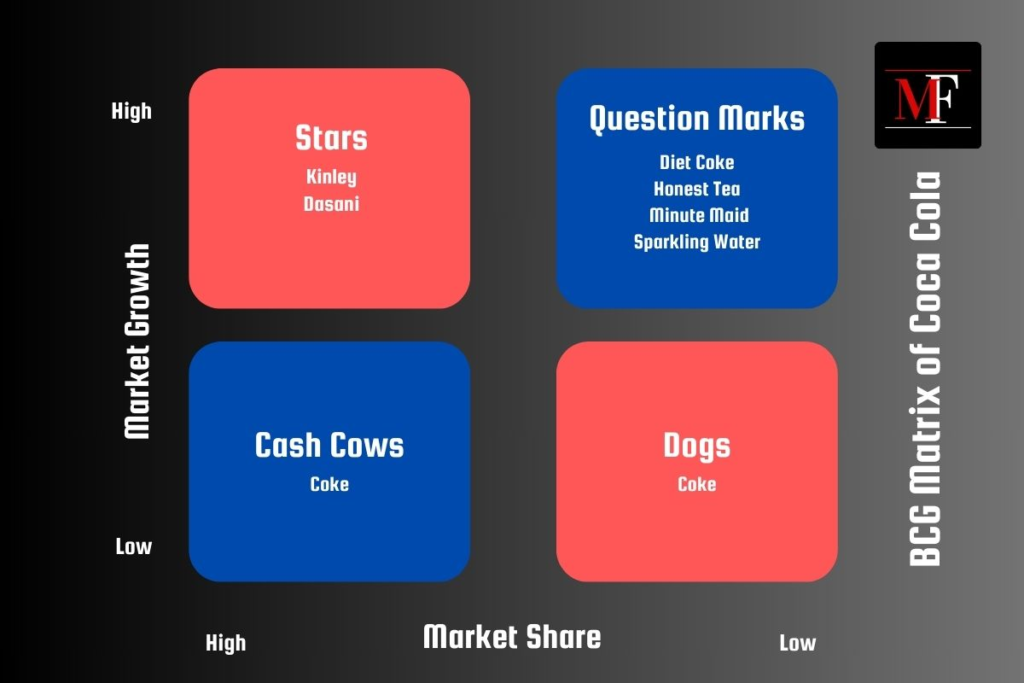

5. BCG Matrix of Coca-Cola

In Coca-Cola’s BCG matrix, Stars include bottled water brands like Kinley and Dasani, which are growing rapidly and generating significant market interest.

Question Marks are products like Diet Coke, Honest Tea, Minute Maid, and Sparkling Water, which have potential but are still in the developmental stage.

Cash Cows refer to the classic Coke product, which generates steady revenue despite slower growth. Dogs are products like Coke that may struggle due to declining interest in carbonated beverages.

6. BCG Matrix of Google

In Google’s BCG matrix, its search engine is considered a Star due to its strong performance and growth. Products like Google Home and Stadia are seen as Question Marks, meaning they have potential but have not fully succeeded yet.

Advertising is a Cash Cow, providing a steady income. Meanwhile, Google Video Player is classified as a Dog because it faces low demand and tough competition.

7. BCG Matrix of Nike

In Nike’s BCG matrix, Stars include Nike shoes and sportswear, which are top sellers and show high growth potential, particularly the popular Nike Air Max.

Question Marks are represented by Nike Converse, which has potential for growth but currently has a low market share and faces competition.

Cash Cows consist of Nike’s equipment and accessories, generating steady revenue despite low growth. Dogs include Nike SB, or Nike Skateboarding, which has limited market presence and growth but remains in the lineup with hopes of revitalization.

8. BCG Matrix of Pepsi

In Pepsi’s BCG matrix, Stars include Gatorade, Aquafina, and Powerade, all of which have high market share and growth potential.

Question Marks are represented by Diet Coke, which has a low market share but could grow significantly with the right strategies.

Cash Cows refer to Frito Lay snacks, which generate strong revenue with minimal investment needed to maintain their market position.

Dogs include Pepsi itself, which has seen declining popularity and contributes little to sales during a shift toward healthier beverage options.

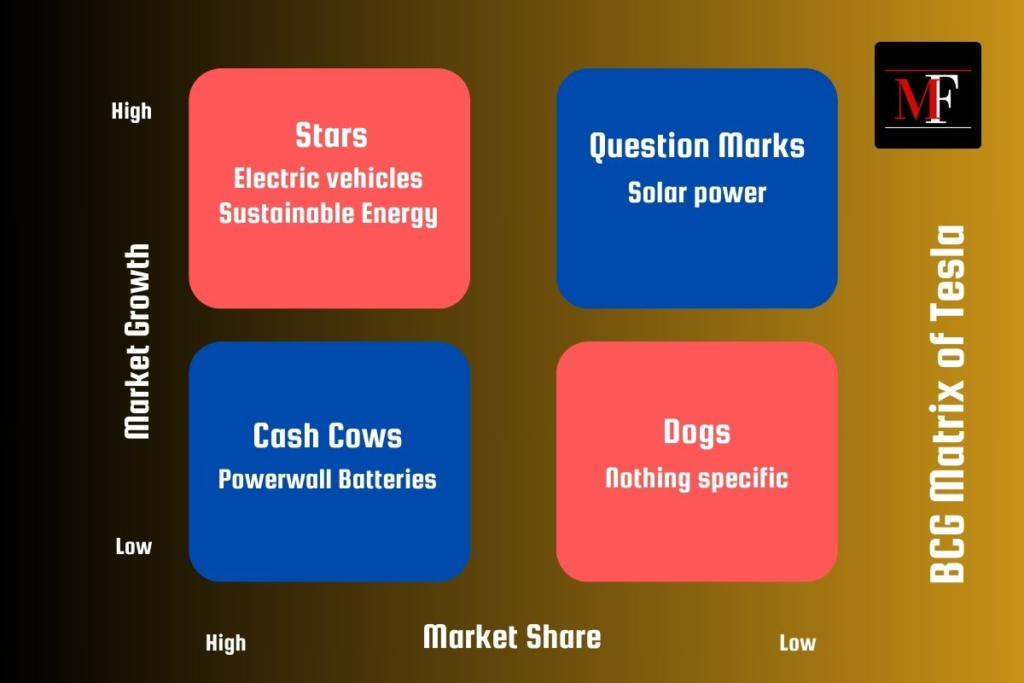

9. BCG Matrix of Tesla

In Tesla’s BCG matrix, Stars includes its electric cars and sustainable energy services, which are leading products.

Question Marks refers to their solar power efforts, which face tough competition but could succeed with more investment.

Cash Cows are represented by the Powerwall battery, which provides steady profits, while Tesla generally lacks clear Dogs, though some models may face production issues and could be reconsidered.

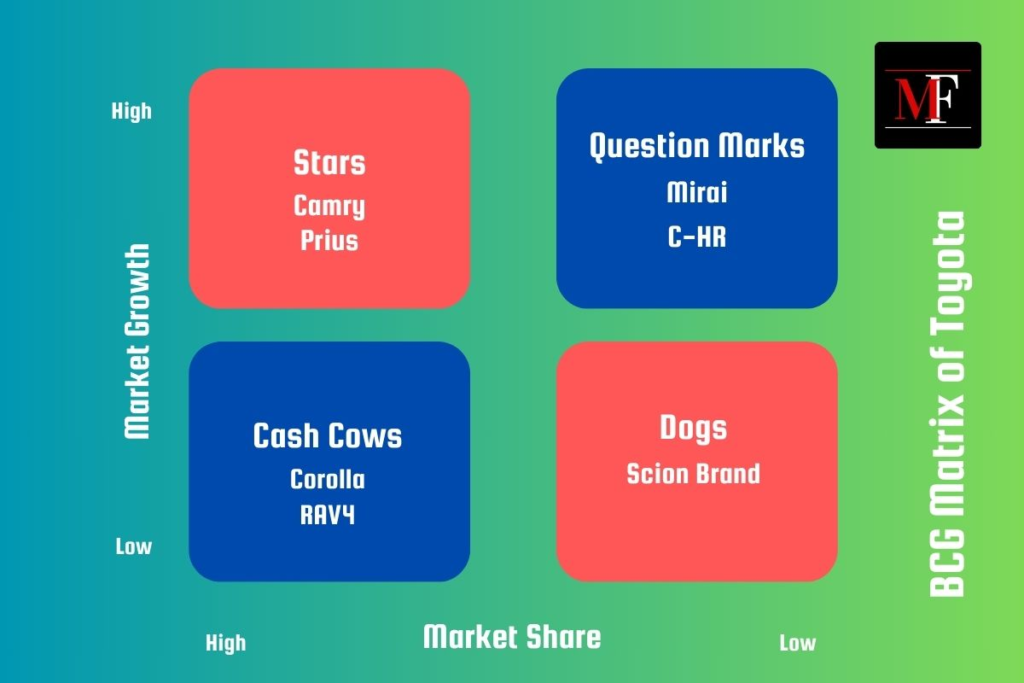

10. BCG Matrix of Toyota

In Toyota’s BCG matrix, Stars are models like the Prius, Lexus, and Land Cruiser, which are highly profitable and in fast-growing markets.

Question Marks include the hybrid Corolla and Camry, as well as the new electric car, Mirai, which have not yet proven their long-term success.

Cash Cows are steady income earners like the Camry, Corolla, and RAV4, while Dogs refer to older models like the Tundra, Scion, Crown, and Celica that are no longer popular with consumers.

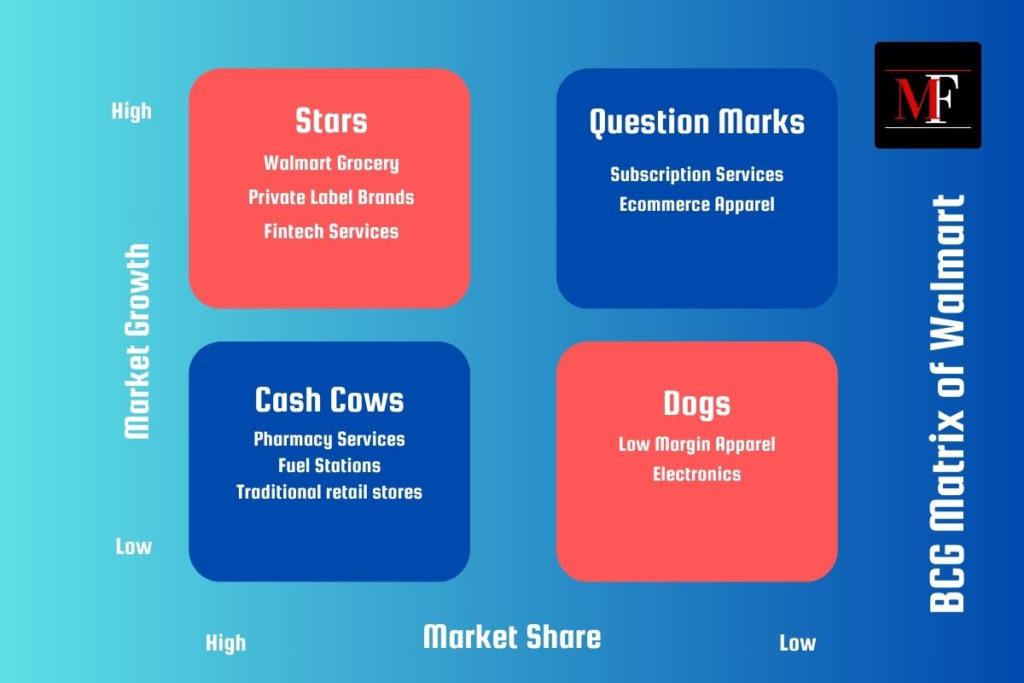

11. BCG Matrix of Walmart

Walmart’s BCG Matrix classifies its business units into four categories. Stars include Walmart Grocery and Private Label Brands, which have high growth and market share.

Cash Cows like Pharmacy Services and Traditional Retail Stores generate steady profits, while Question Marks such as E-commerce Apparel have potential but face competition.

Dogs consist of certain Electronics and low-margin Apparel, which have low market share in slow-growing markets.

12. BCG Matrix of KFC

In KFC’s BCG matrix, Stars include a strong market presence in China, where sales are growing rapidly. Cash Cows are represented by KFC in the United States, which generates steady revenue but lacks significant growth.

Question Marks involve markets in Muslim countries affected by boycotts, making their future uncertain. Dogs also apply to KFC USA, which has a declining market share despite still generating substantial revenue.

13. BCG Matrix of Amul

In Amul’s BCG matrix, Stars include high-growth products like the Pure Ghee range, dairy whiteners, ice creams, Amul Kool, and cheese spread.

Cash Cows are products with a steady market presence but limited growth, such as mozzarella cheese, Amul butter, and fresh milk.

Dogs refer to products with weak market positions and low growth potential, including Amul Pizza, infant milk, Amul Shakti, energy drinks, and chocolates.

Question Marks consist of products like Amul lassi, masti dahi, mithai mate, boxed milk, and mithai range, which have weak market positions but high growth potential.

14. BCG Matrix of Samsung

In Samsung’s BCG matrix, Stars include smart TVs, which have high market share and growth due to ongoing innovation and strong performance.

Question Marks are represented by Samsung’s laptops, which are still developing and have a low market share but could grow with effective management.

Cash Cows consist of home appliances like washing machines and refrigerators, which generate stable revenue with minimal investment despite slow growth.

Dogs are Samsung’s printers, which have low sales and contribute little to overall growth, making them less attractive for investment.

15. BCG Matrix of Dell

In Dell’s BCG matrix, Stars include visualization software, cloud computing, enterprise networking solutions, cybersecurity services, and hyper-converged infrastructure, all of which have high market share and growth.

Cash Cows consist of Dell laptops, desktops, server systems, peripheral devices, and support services, generating steady revenue with minimal investment.

Dogs refer to consumer printers, legacy software, portable media players, and low-margin electronics, which have low market share and profitability.

Question Marks are represented by AI initiatives, IoT solutions, quantum computing research, blockchain technologies, and 5G implementations, all showing growth potential but requiring significant investment.

Note: The data might change with time; therefore, it is recommended to confirm from other sources.