The BCG matrix, created by the founder of Boston Consulting Group in the 1970s, helps businesses develop strategies for their products. It sorts the brand portfolio into stars, cash cows, question marks, and dogs based on market share and growth rate. You can read our detailed blog post on BCG matrix in marketing.

In today’s analysis of Nestlé using the BCG matrix, we will examine how the company’s products are doing in their markets. Let’s start with a brief introduction of Nestle.

A brief History of Nestle

In 1867, Henri Nestlé introduced a new baby food product under the name Farine Lactée Henri Nestlé. Around the same time, brothers Charles and George Page founded the Anglo-Swiss Milk Company, also producing baby food. By 1905, these companies merged to form Nestlé and Anglo-Swiss Condensed Milk Company, expanding into the US, UK, Germany, and Spain.

Originally focusing on baby food and condensed milk, Nestlé’s product range grew through expansions and acquisitions. Today, they offer chocolates, coffee, noodles, bottled water, ice cream, and more. With a net worth of $270 billion in 2024, Nestlé is among the leading forces in the food and beverage industry.

BCG Matrix Analysis of Nestle

Nestlé has an extensive and varied brand portfolio that features over 2,000 products available globally. Remarkably, despite this vast range, Nestlé consistently maintains a leading position across its covered markets. An analysis of Nestlé’s BCG matrix may shed light on the reasons behind Nestlé’s impressive performance.

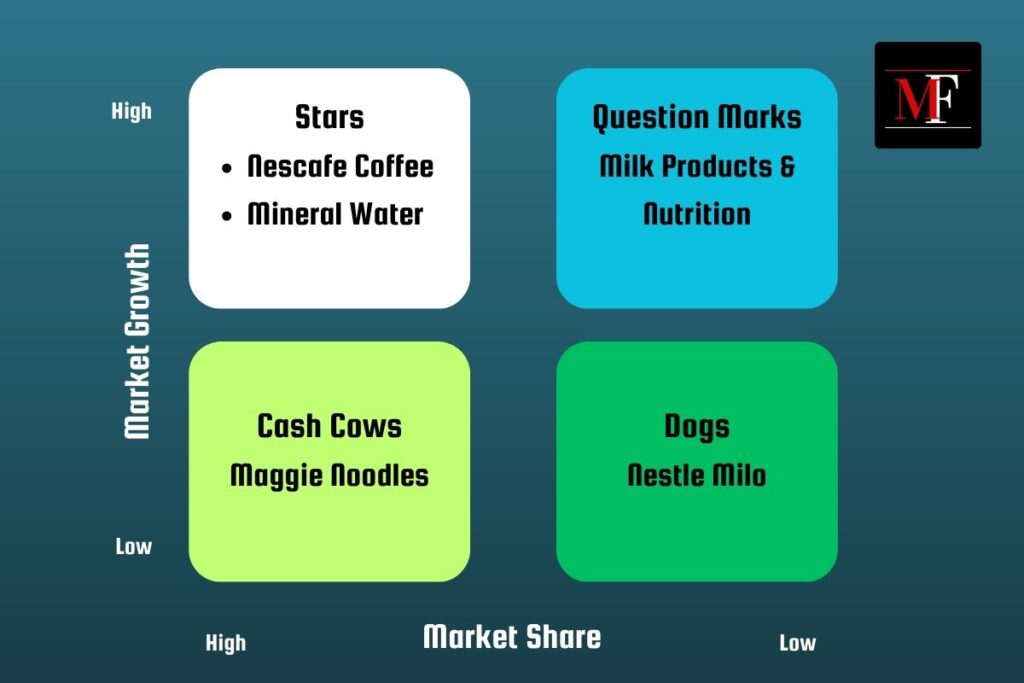

It is important to note that this analysis is based on the latest data. Let’s explore the four elements of BCG matrix in context to Nestle. Here is the BCG matrix diagram of Nestle.

1. Stars

In the BCG matrix, stars represent products with large market shares in fast-growing industries. Nestlé’s BCG matrix highlights mineral waters such as Pure Life and Nestlé Waters, as well as innovative Nescafe Coffee varieties like the Creamy Latte, in Stars category.

These products have the potential to become cash cows with strategic investments. With their strong presence in the market and high growth rates, they offer an opportunity for rapid advancement.

By leveraging this potential, Nestlé can boost their transition from star to cash cow to strengthen their position in the market and ensure profitability in long term

2. Question Marks

Question marks are products in early development stages, often in stagnant markets. Nestlé’s question marks include their milk products and chocolates.

These are superior products, with some already achieving star status in certain regions. However, these markets face tough competition and require significant investment for leadership. There is also a risk they may fall into the Dog category over time.

3. Cash Cows

Cash cows are products that generate steady revenue in a mature market and require minimal investment. In Nestlé’s BCG matrix, Maggi Noodles hold a prominent place in this category with an impressive 85% market share.

Maggi Noodles have earned strong consumer loyalty, making them a reliable source of income for Nestlé. This enduring popularity strengthens their position as a cash cow in Nestlé’s portfolio, ensuring continued success.

Nestlé’s adeptness at leveraging established products exhibits its ability to maintain enduring profitability.

4. Dogs

In Nestlé’s BCG matrix, dogs represent products struggling to gain traction and generate significant income. A continuous support for them may demand heavy investment, making it impractical for the business. Milo, the chocolate malt drink, falls into this category for Nestlé due to its limited impact on the market.

You can also read about BCG matrix analysis of Apple Inc.

Summing it up

Nestlé’s BCG matrix highlights the top-performing brands like Maggi Noodles, which serve as cash cows, while Nescafe and Nestlé Waters show promise to join this category. Milk products and chocolates require closer examination to determine their potential as stars. BCG matrices influence marketing and positioning strategies, especially for diverse companies like Nestlé.