UnitedHealth Group is an American company based in Eden Prairie, Minnesota. It focuses on health insurance and healthcare services. The company sells insurance under the UnitedHealthcare name and healthcare services under the Optum brand. It is the largest healthcare company in the world in terms of revenue and the ninth-largest company overall.

As of December 20, 2024, UnitedHealth Group had a market value of $460.3 billion. The company ranked 8th on the 2024 Fortune Global 500 list.

UnitedHealth Group Business Overview

UnitedHealth Group is a large health and wellness company. Its goal is to help people lead healthier lives. The company operates in two main areas.

- UnitedHealthcare, which offers healthcare coverage and services.

- Optum, which provides healthcare services powered by technology.

UnitedHealth uses a combination of clinical expertise, technology, and data to improve health outcomes and make healthcare systems more efficient.

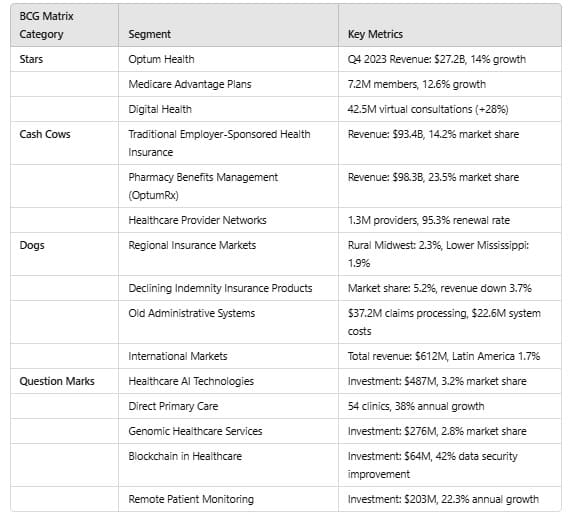

BCG Matrix of UnitedHealth

UnitedHealth Group divides its business into different categories using the Boston Consulting Group (BCG) Matrix. These categories show how each part of the business is doing in terms of market share and growth.

a. Stars in BCG Matrix of UnitedHealth

These segments perform well in the market and have strong growth potential:

Optum Health

- Q4 2023 revenue: $27.2 billion (14% growth from last year)

- Market share in healthcare services: 22.3%

- Medicare Advantage Plans: 7.2 million members (35.4% market share)

- 12.6% growth in membership

- Digital health services: 42.5 million virtual consultations, 6.3 million platform users

- Expanded into 6 new countries, with $3.6 billion in revenue

Medicare Advantage Plans

- 7.2 million members, growing at 12.6% per year

Digital Health

- 42.5 million virtual consultations (+28%)

- 6.3 million digital health users (+18.7%)

b. Cash Cows in BCG Matrix of UnitedHealth

These segments have stable revenue but little room for growth:

Traditional Employer-Sponsored Health Insurance

- Revenue: $93.4 billion (2022)

- Market share: 14.2%

- Enrollment: 49.4 million members

Commercial Health Insurance Plans

- Profit margin: 4.7%

- Operating margin: 6.2%

- Return on equity: 22.1%

Pharmacy Benefits Management (OptumRx)

- Processed 1.5 billion prescriptions in 2022

- Revenue: $98.3 billion

- Market share: 23.5%

Healthcare Provider Networks

- Network includes 1.3 million providers, covering all 50 U.S. states

- Contract renewal rate: 95.3%

c. Dogs in BCG Matrix of UnitedHealth

These segments are struggling or have limited future potential:

Regional Insurance Markets

- Rural Midwest: 2.3% market share ($124 million in revenue)

- Lower Mississippi Valley: 1.9% market share ($98 million in revenue)

Declining Indemnity Insurance Products

- Market share: 5.2%

- Revenue decreased by 3.7%

- Enrollment down 2.9%

Old Administrative Systems

- High operational costs and poor efficiency

- Claims processing maintenance costs: $37.2 million

- Outdated enrollment system: $22.6 million

International Markets

- Total international revenue: $612 million

- Latin America market share: 1.7%

- Europe market share: 2.3%

d. Question Marks in BCG Matrix of UnitedHealth

These segments are growing but have uncertain profits:

Healthcare AI Technologies

- Investment: $487 million

- AI market share: 3.2%

- Focus areas: Diagnostic AI, Predictive Analytics, Risk Stratification

Direct Primary Care

- Current clinics: 54, expected to grow to 120 by 2025

- Patient base: 127,000

- Projected growth: 38% annually

Genomic Healthcare Services

- Investment: $276 million

- Market share: 2.8%

- Potential growth: Genetic screening and precision medicine

Blockchain in Healthcare

- Investment: $64 million

- Estimated data security improvement: 42%

- Cost reduction in administration: 18%

Remote Patient Monitoring

- Investment: $203 million

- Projected growth: 22.3% annually

- Wearable health devices: 352,000 users

- Telehealth platform: 478,000 users

Conclusion

UnitedHealth Group wisely distributes its resources across various business areas. It is growing in digital health, AI technologies, and primary care while still making a steady income from employer-sponsored insurance and pharmacy services.

However, the company faces challenges in certain regional markets and outdated systems. Its future success depends on managing investments in new technologies and maintaining leadership in its main areas.

Primary Data Sources